While inflation expectations fell from June, they began to rise again intra-month...

by Tyler Durden

Friday, Jul 29, 2022 - 10:09 AM

While the headline sentiment index from UMich has tended to make all the headlines historically - since it hit record lows, flashing a big red "pants on fire" indicator for the administration's insistence that we are not in recession, all eyes have refocused on the inflation expectations sub-component. The preliminary prints showed short- and medium-term inflation expectations slide notably - easing The Fed's fears (as Powell pointed out this indicator specifically) - we note that the 5-10Y inflation expectation picked up from 2.8% to 2.9% intramonth, while the 1Y inflation expectation held its 5.2% (lower) print...

Source: Bloomberg

“Inflation continued to dominate consumers’ attention, and labor market expectations continued to soften,” Joanne Hsu, director of the survey, said in a statement.

Nearly half of respondents said inflation is weighing on their personal finances, which was exceeded only once before -- in 1951.

The year-ahead economic outlook dropped to the lowest level since 2009, Hsu said.

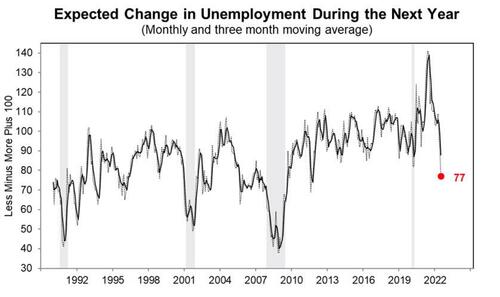

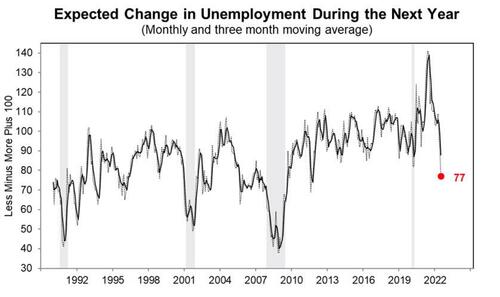

Unemployment expectations deteriorated for the third consecutive month, worsening by 14% from last month and 44% from a year ago, reaching its lowest reading since 2011

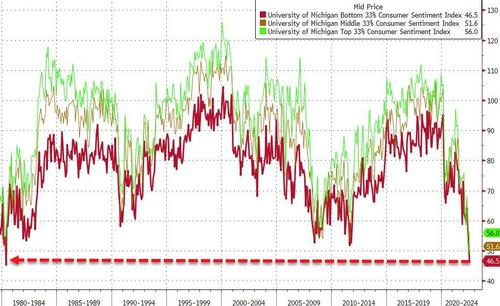

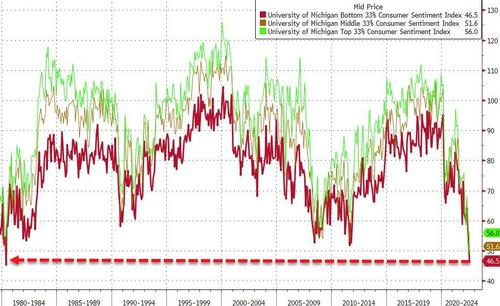

So with that out of the way, the final print for July's UMich sentiment survey rose very modestly intra-month from 51.1 to 51.5 (from record low 50.0 in June), but expectations slipped further to its worst since April 1980...

Source: Bloomberg

Across political cohorts, Democrats' sentiment weakened further in July while Republicans and Independents saw a modest uptick...

Source: Bloomberg

Buying Conditions improved modestly MoM but weakened intramonth, but still barely off record lows...

Source: Bloomberg

Finally, the lowest income group saw sentiment weaken to near record lows as middle- and high-income cohorts rebounded in July...

Source: Bloomberg

“Consumers are finding ways to cope by altering their spending patterns as high prices persist,” Hsu said. “Going forward, these behavioral adjustments are likely to grow.”